The emergence of CBD has been a game-changer for the cannabis industry. Prior to 2018, as more states legalized medicinal and creational cannabis use, THC was the cannabinoid most consumers were familiar with. Yet when the US Farm Bill passed at the end of 2018, which made growing hemp legal, the cannabinoid CBD quickly became something that consumers were interested in, given its purported therapeutic effects. That also meant CBD became the launching platform for many product categories. In 2019, product designers were quick to develop CBD products for the marketplace like tinctures, gummies, and capsules, followed by beverages, baked goods, and confections to capitalize on consumer interest.

In 2019 when CBD products started to emerge, the main decision a product producer had to make was whether to choose Isolate or Broad Spectrum CBD for their product, depending on the flavor profile they wanted to achieve or whether or not they wanted the consumer to benefit from the Entourage Effect. A lot has changed since then, as the opportunity to go beyond those two choices is seemingly limitless.

2020 and Beyond: The Evolution and Expansion of Infused Products

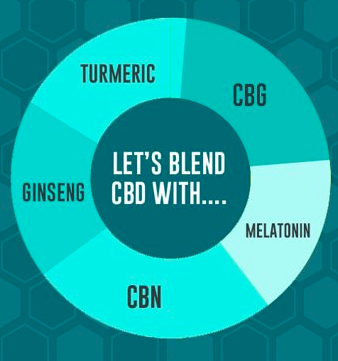

The CBD-infused product market that has matured and grown rapidly in the last several years, with brands establishing themselves and gaining a good foothold in the market. In that time, consumers have also become more accepting and more knowledgeable about CBD. These informed and experienced consumers who may have tried numerous products have elevated expectations when it comes to what they purchase, and with each new product innovation, the bar is raised higher. In 2021, the CBD market is poised to evolve and differentiate itself, allowing product developers to take their brand to the next level. The next wave of products in this ever-popular, ever-expanding marketplace will feature custom emulsion blends with ingredient pairings and combinations; this movement will create differentiation in product lines. Given the number of minor cannabinoids, terpenes, adaptogens, and nootropics that could be paired with CBD, the unique combination possibilities are truly endless.

The New Frontier: CBD + (fill in the blank)

Now more than ever, consumers are highly focused on their wellness and are seeking out products that feature ingredients they believe have significant health benefits. Moving forward, this likely means that product developers will look to pair CBD with functional ingredients like Zinc, Vitamin C, Melatonin, L-theanine, nootropics, or adaptogens. Currently, there are a number of products on the market featuring CBD and Magnesium and L. theanine. Magnesium is a mineral that is critical for helping the body operate properly, particularly for those suffering from inflammation, as it supports muscle and nerve function. L. theanine is an amino acid found in green and black tea as well as some mushrooms; people use it to improve cognitive function as well as for stress and anxiety. Product developers are also pairing CBD with secondary cannabinoids like CBN, CBC, and CBG and as well as prioritizing products that are clean label – organic, natural, and/or vegan.

These product development decisions are typically grounded in the brand’s goals and objectives and what the path forward should be based on the customers’ needs. If more brands expand their lines in this way, the market will likely see products with increasingly unique combinations of functional ingredients created for a specific therapeutic effect. For more information on functional ingredients trends, check out our two-part blog post, “All About Adaptogens” and “Restoring Protein, Balancing Gut Health, and Boosting Immunity.”

Your RESōRSE for the New Frontier

As brands look to expand their offerings to include products infused with CBD and other functional ingredients, SōRSE has positioned itself to be a full solution provider, as a collaborator in the product development process, and as a solution-oriented, strategic partner. Beyond providing a delivery system for bioactive compounds including cannabinoids, terpenes, adaptogens and nootropics, our R & D team is comprised of formulation experts who are always up for a challenge. When a product developer works with SōRSE, they have the full support of the team to get the product off the ground, as well as access to our certified network of suppliers and co-manufacturers. Through each phase of the product development process – ideation, custom emulsion creation, quality assurance and testing, production planning – SōRSE is a partner and resource to its customers. Take the first step by booking a call today to tell us what you hope to achieve with your brand so we can help make your dream of a new infused product a reality.